Salary slips, bank statements, KYC documents, and a stable income profile.

Personal Loans (PL)

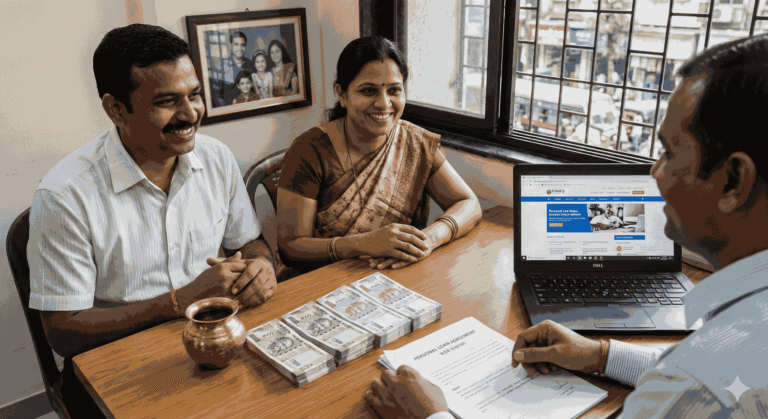

At Vikas Shelar & Associates, we simplify the personal loan process by connecting you with the most suitable lenders and the best available offers. Our expert team handles comparisons, documentation, and coordination to ensure fast approvals and stress-free loan processing. Whether you need funds for emergencies, travel, education, or personal expenses, we guide you every step of the way with clarity and confidence.

- Fast approvals through streamlined loan application support

- Best loan offers from trusted banks/NBFCs

- Minimal documentation with complete assistance throughout

- Personalized loan solutions for every financial need

Why Choose Us

At Vikas Shelar & Associates, we simplify the process of securing personal loans by connecting you with the best offers from trusted banks and NBFCs. Our advisory ensures quick approvals, transparent guidance, and personalized solutions tailored to your financial needs.

Maximum Benefits

Secure competitive interest rates and flexible terms designed to maximize your loan advantages.

Hassle-Free Process

Enjoy smooth documentation handling and quick approvals with complete support throughout every step.

Tailored Solutions

Get personalized loan recommendations aligned with your income, goals, and repayment abilities.

Expert Guidance

Receive clear, accurate loan advice ensuring you select the ideal funding option confidently.

Loan Calculator

Loan Breakdown

What We Offer

At Vikas Shelar & Associates, we simplify the entire personal loan journey by handling documentation, coordinating with banks/NBFCs, comparing offers, and ensuring you receive the most suitable loan at the best possible rate.

- Personalized loan eligibility assessment

- Comparison of multiple banks/NBFC loan offers

- Comparison of multiple banks/NBFC loan offers

- Advisory on choosing the best interest rates & tenure

- Loan restructuring and repayment guidance

- End-to-end support until successful loan disbursement

Our Simple & Efficient Loan Assistance Workflow

We follow a structured and transparent approach to make your loan journey stress-free. By thoroughly analyzing your financial statements, business performance, and funding requirements, we match you with the most suitable lenders and negotiate favorable terms.

Understanding Your Profile

We analyze income, credit score, financial needs, and eligibility to identify suitable loan options.

01Selecting the Best Offer

We compare leading lender offers to find the most favorable interest rates and terms.

02Application & Documentation

We guide you through documentation, file submission, and lender coordination for quick approval.

03Disbursement Support

We assist until funds are credited, with continued support for future loan needs.

04

Benefits You Receive

By choosing our Business Loan advisory, you gain structured financial support that reduces funding challenges and empowers sustainable business growth. Our experts ensure smooth processing, optimized interest rates, and complete compliance, allowing you to focus on scaling your business without financial stress.

- Access to multiple lenders for best loan deals

- Faster processing and reduced approval time

- Lower interest rates through expert negotiation

- Hassle-free documentation and paperwork assistance

- Zero hidden charges or misleading commitments

- Complete transparency and personalized financial advice

Frequently Asked Questions (FAQs)

-

1 _ What is the minimum requirement for a personal loan?

-

2 _ Which banks/NBFCs do you work with?

We work with leading nationalized and private banks, along with top NBFCs.

-

3 _ Can I apply if my credit score is low?

Yes. We help identify lenders offering flexible credit policies.

-

4 _ Do you charge any upfront fees?

No hidden charges. All service fees are fully transparent.

-

5 _ How long does approval typically take?

Depending on the lender, approvals can be completed in 24–48 hours.